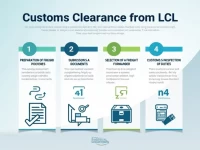

Streamlining International Parcel Customs Clearance Key Steps

This article provides an in-depth analysis of key points for completing international small packet customs declaration forms, emphasizing the accuracy and completeness of three core elements: main information, goods attributes, and trade background. It also offers strategic filling techniques, such as utilizing HS codes effectively, avoiding vague terms, and maintaining consistency across all three documents, to help businesses improve customs clearance efficiency and reduce logistics costs. Buyun.com offers professional international logistics consulting and intelligent real-time price comparison services to safeguard your international trade.